We can’t control the market around us, especially in the economic downturn produced by the pandemic, but we can choose how to respond to it.

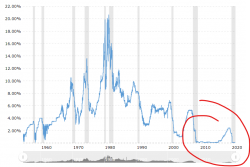

In a low-interest rate market environment like the US has experienced for the period 2008-2015 following the credit crunch, and again for the period April 2020 onwards, this makes it very challenging for banks to earn interest margins through lending. One strategy that some of our clients have followed is to encourage their commercial banking clients to make the most of treasury services, which generate fee income and aren’t dependent on interest rates. These treasury services are varied transaction and information services that help businesses manage their cash deposits and inter-party transactions. The image on the right illustrates the federal funds rate history for the period 1954-2021, with emphasis on the most recent years. When the federal funds rate is low, the interest rate that banks can charge on loans to their customers is correspondingly low.

Corios was hired by a super-regional bank to help their commercial bank optimize lead sourcing, revenue capture and closed-loop CRM for their treasury management products and services. We started by building the strategy for our banking client by designing the closed-loop capability for identifying clients who could get value from treasury services, enabling bank officers who represented those clients to deliver guidance about the best treasury services for each client, and then tracking the adoption and utilization of those services by the clients. As the system was used to monitor progress, the identification, targeting, outreach and adoption improved as the bank’s officers and leaders saw which tactics worked best and others didn’t.

Treasury management services include a bundle of 20 or more products and services that are highly technical and require support from a treasury management officer (TMO) specialist. The TMO helps the commercial banking relationship owner to qualify the opportunity, tailor the pitch and set the hook.

In our experience, there are rarely enough TMOs to go around, and most commercial bankers don’t know enough to drive those sales on their own. Addressing the sales organization’s acceptance of such an idea was the biggest challenge to its ultimate success. Corios found the solution provider needs to invest the cycles with sales leadership and management, down to the trainers and individual sales managers, over time, to really get it to stick. The best way to start is with a pilot in one or two banking centers and use that experience to create quick success stories.

Ensuring security and privacy

Another factor that’s critically important is to build the security, reliability and privacy of this system in from the ground floor of the operation. Corios has been an SSAE16 SOC2 Type 2-audited service provider since 2015 and a PCI-DSS-audited service provider since 2017. This certifies that Corios is well established to design, construct, operate and monitor these information platforms for our clients. This is available to our clients under the Corios Legato solution banner.

Moving the platform to the AWS cloud

We originally built this platform on the data center and managed services capabilities of a private cloud provider, and then moved this platform to AWS in 2020 to reduce the costs of operation. AWS makes it pretty easy to perform these migrations which included moving a SQL Server database, and our ETL and analytics workloads which were built on the SAS Institute engine. AWS provided less expensive storage and compute, and then later on introduced licenses for Microsoft SQL Server that provided encryption without needing to license the TDE release of SQL Server, again saving the client substantial costs. The migration transition costs were relatively low and we also completed our SOC2 and PCI audits on the new environment without issue, made easier because AWS also certifies their cloud services for the same audit standards.

Our analytics rules and models were built using the Corios model factory approach, where we leverage the best practices of a cloud environment to rapidly build and deploy the analytics predictors for customer adoption and utilization. Since there are about 20 treasury products, and we built an adoption model and a revenue model for each product, that’s more than 40 models. Usually that would require a year or more to build these, and longer to deploy them in production, but since Corios has reusable templates for treasury products, it only required a couple of months to complete all this work.

The system back-end consists of:

- a relational database schema that combines eight different sources of data about all the bank’s commercial customers, to build a 360-degree view of their history, characteristics and needs;

- an analytic engine that is used to combine predictive models and business rules that map the best treasury services to each client’s needs;

- a CRM that delivers the customer profile, needs and targeted treasury services for each client and bank relationship manager; and

- a tracking mechanism that enables the bank’s strategists and sales leadership to refine the targeting, outreach and service adoption for each client.

What did we learn?

Over time, we learned an important lesson: bank relationship managers aren’t citizen data scientists. Rather than reviewing a rich complement of information about each client’s profile and treasury needs, and choose from among the best 3 or 4 offers for each client, they were more ready to simply present the best single offer to the client on the day it was refreshed. The client treasury service adoption rate rose from 5% when we introduced the treasury targeting system, to nearly 20% once we simplified the presentment.

We also learned that the cultural adoption of changes in the way that relationship managers use rich, analytic information is entirely dependent on ongoing coaching, assistance, problem solving and creating internal change leaders on the ground floor. The technology alone is an enabler, but the client’s banking officers were far more encouraged by the successes of their peers.

Want to learn more about effective closed-loop cross-sell processes and engines leveraging cloud services and rapid delivery? Click here to learn more about Corios Rosetta. Or email me today at president@coriosgroup.com.